“I use my credit card to pay credit cards

I use another one to pay rent

I’m throwing nickels at my student loans

And they haven’t made a dent“

(FROM “KEEP THE CHANGE”, BY THE COPYRIGHTS, 2014)

By Scott Welch, CIMA®, Chief Investment Officer & Partner

Reviewed by Carter Mecham, CMA®, IACCP®

Most of the media attention recently has focused on the equity markets, given the tariff uncertainty-induced volatility (although as we write this, the market is in a good mood with both the US and China backing away from a trade war).

But there is another part of the capital markets – the rates and credit market. Most times it takes a back seat to the equity markets, but investors should still be aware of what is happening. The two markets are not mutually exclusive, and it is important to know what is going on in both in order to make informed investment decisions.

So, let’s dive in.

Let’s Start with Rates

The yield curve has been fairly volatile this year, reacting to various news regarding the Fed, tariffs, the economy, and geopolitical tensions. Historically, US Treasuries have been the “risk off” safe haven asset for investors fearing heightened volatility in the global markets.

However, some of this year’s events resulted in some analysts questioning whether that would continue. While we may be evolving into a different regime over time, we believe the current concerns are overblown.

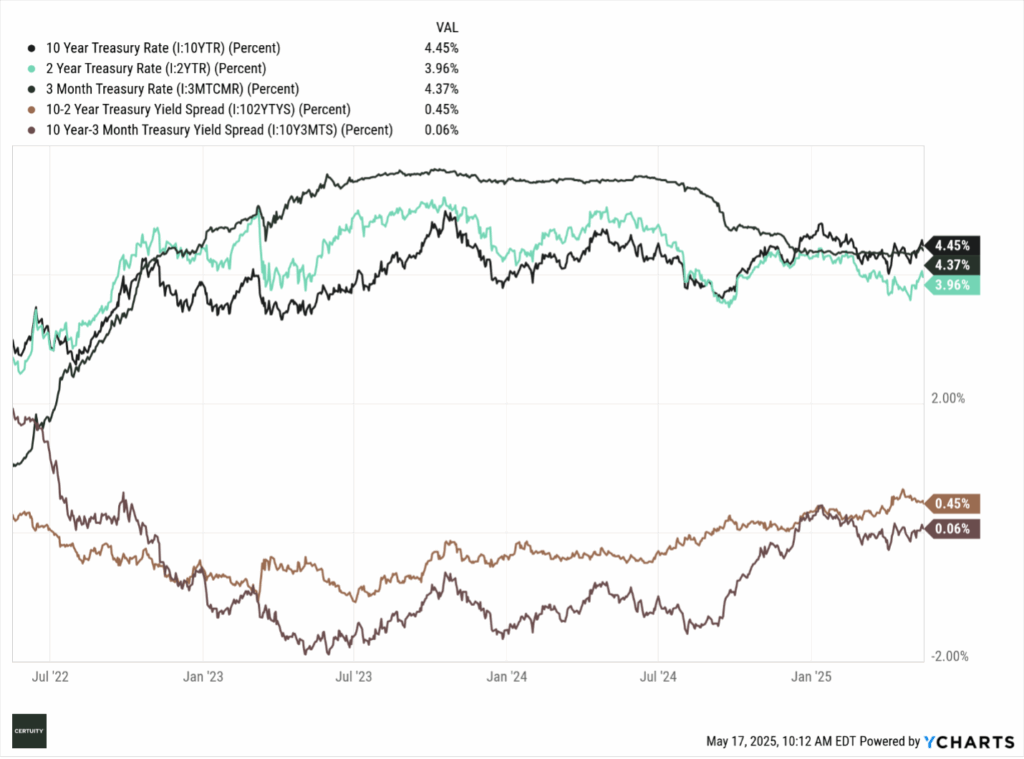

Source: Ycharts, 3-year data as of May 16, 2025. Past performance is no guarantee of future results.

Although the yield curve is fairly flat (with only roughly 50-bps difference between the 10-year and 2-rates and less than 10-bps difference between the 10-year and 3-month rate) it has regained its “normal” upward sloping shape.

After spiking to almost 4.80% in mid-January during the heights of the “Trump Bump” expectations, the 10-year rate then fell to almost 4.00% in early April following the “Liberation Day” tariff announcements. It has since stabilized at around 4.25% – 4.50%.

We think it relevant to point out that, historically, a 5.00% 10-year rate was considered “normal.” So, while rates have risen since the “zero interest rate policy” days, we would not consider them to be “elevated” by historical standards.

Barring unexpected economic or political events, we anticipate rates will trade within the 4.25% – 4.75% range for the remainder of 2025, with the general pressure being upward, not downward. We also expect, however, heightened volatility as events play out and the markets react accordingly.

Source: TradingView, the ICE BoAML “MOVE” index, as of May 16, 2025. You cannot invest in an index and past performance is no guarantee of future results. The MOVE index is a measure of US interest rate volatility, reflecting market expectations for future volatility within the US fixed income market.

Credit Spreads

Next, let’s take a look at credit spreads.

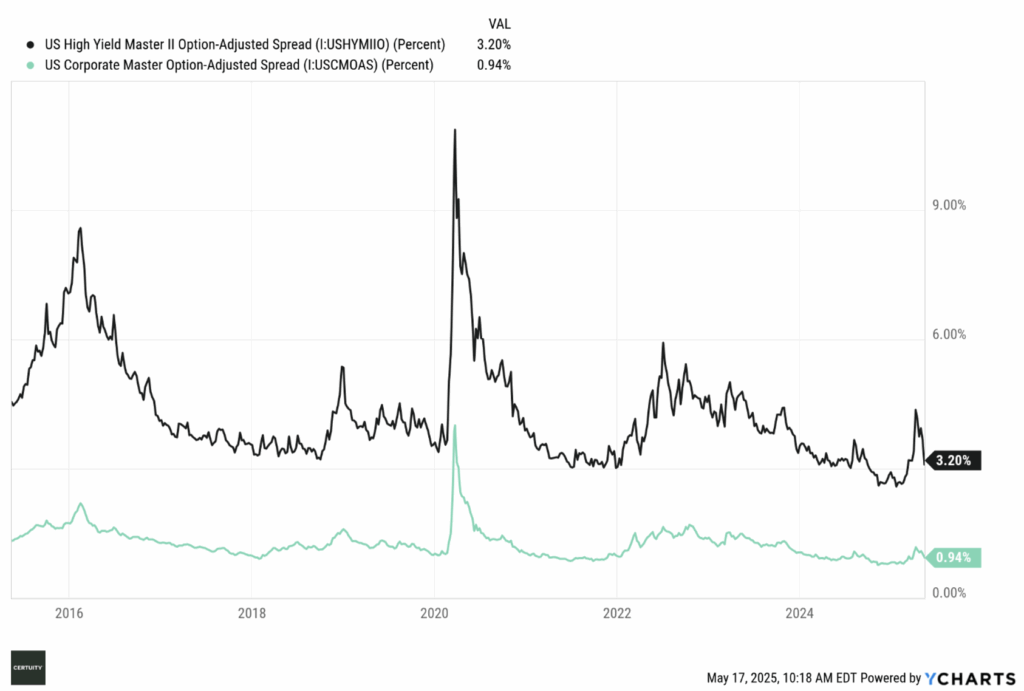

Source: Ycharts, 10-year data through May 16, 2025. You cannot invest in an index and past performance is no guarantee of future results.

Not unexpectedly, spreads, especially in high yield, widened during the “tariff terror” of April, but have started to recede since then as the risk of a trade war seems to have (for now) also receded. If we remove that short-term spike, however, we see that spreads are as tight as they have been for most of the past ten years.

We believe the current investor coupons are relatively safe, as many companies took advantage of the low-interest rate environment of a few years ago and refinanced their debt.

Now, let’s look at some “numbers behind the numbers.”

Numbers Behind the Numbers

Upgrades and Downgrades

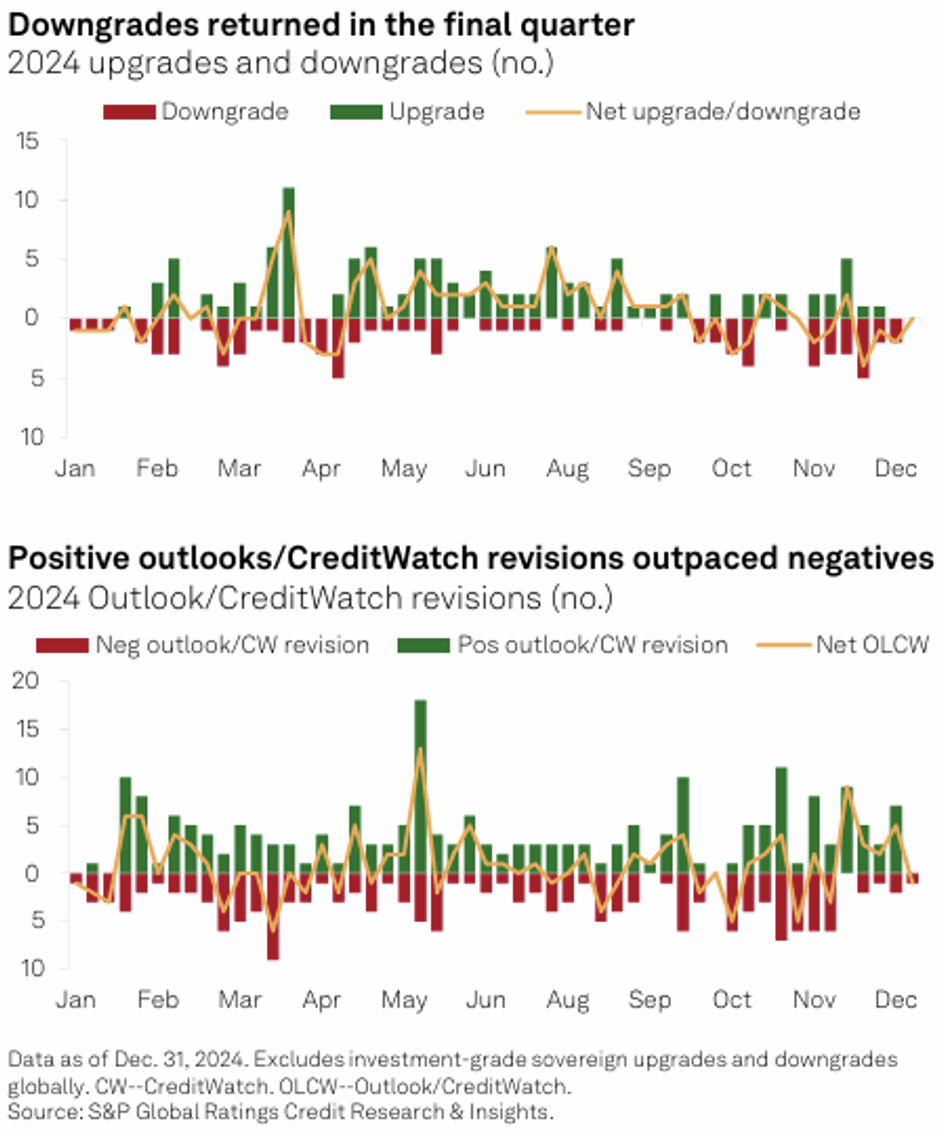

According to S&P Global Ratings, 2024 was essentially neutral with respect to credit ratings upgrades versus downgrades. As we said, corporate balance sheets seem to be in fairly decent shape.

Source: S&P Global Ratings, as of January 2025.

Maturity Wall

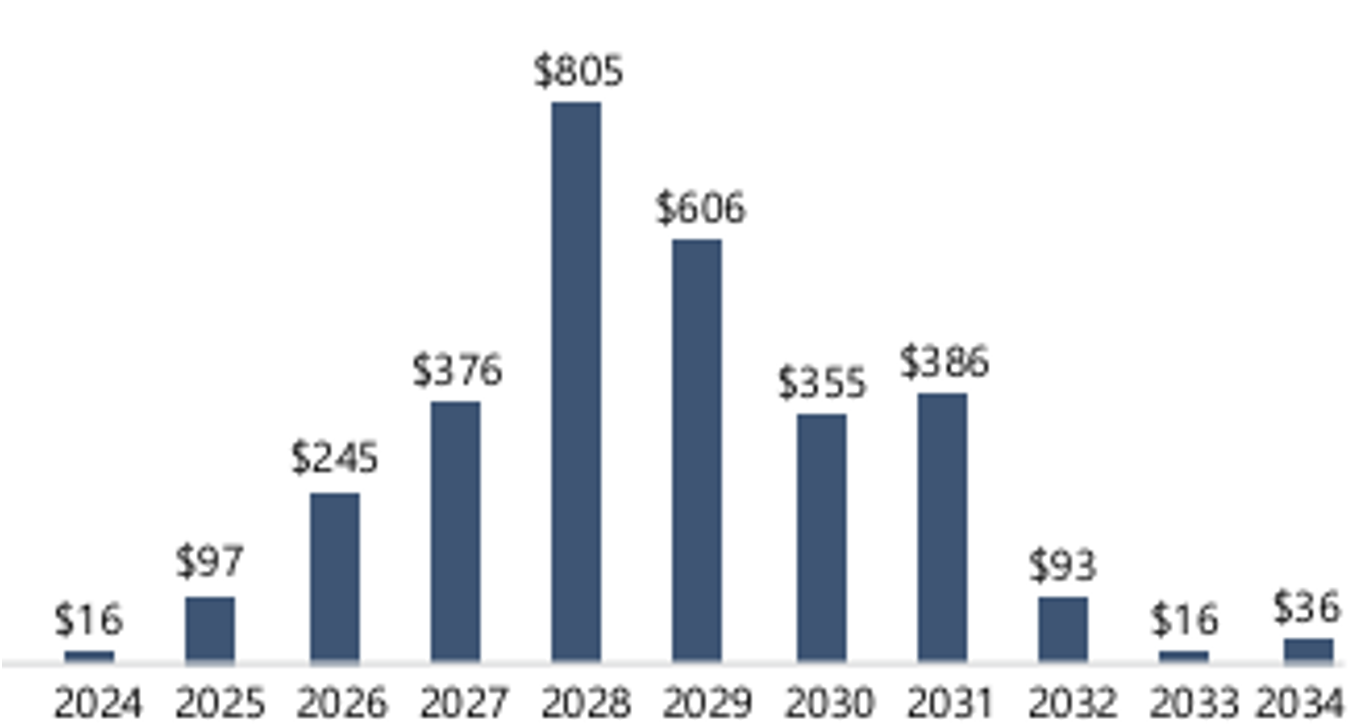

With respect to the so-called “maturity wall” — the year that companies will need to refinance currently outstanding debt — high yield borrowers have done a respectable job “pushing out” their maturities as the bulk are not due for refinancing until 2028.

Source: Apollo Academy, “2025 Credit Outlook: Defying Gravity,” January 2025.

Default Rates

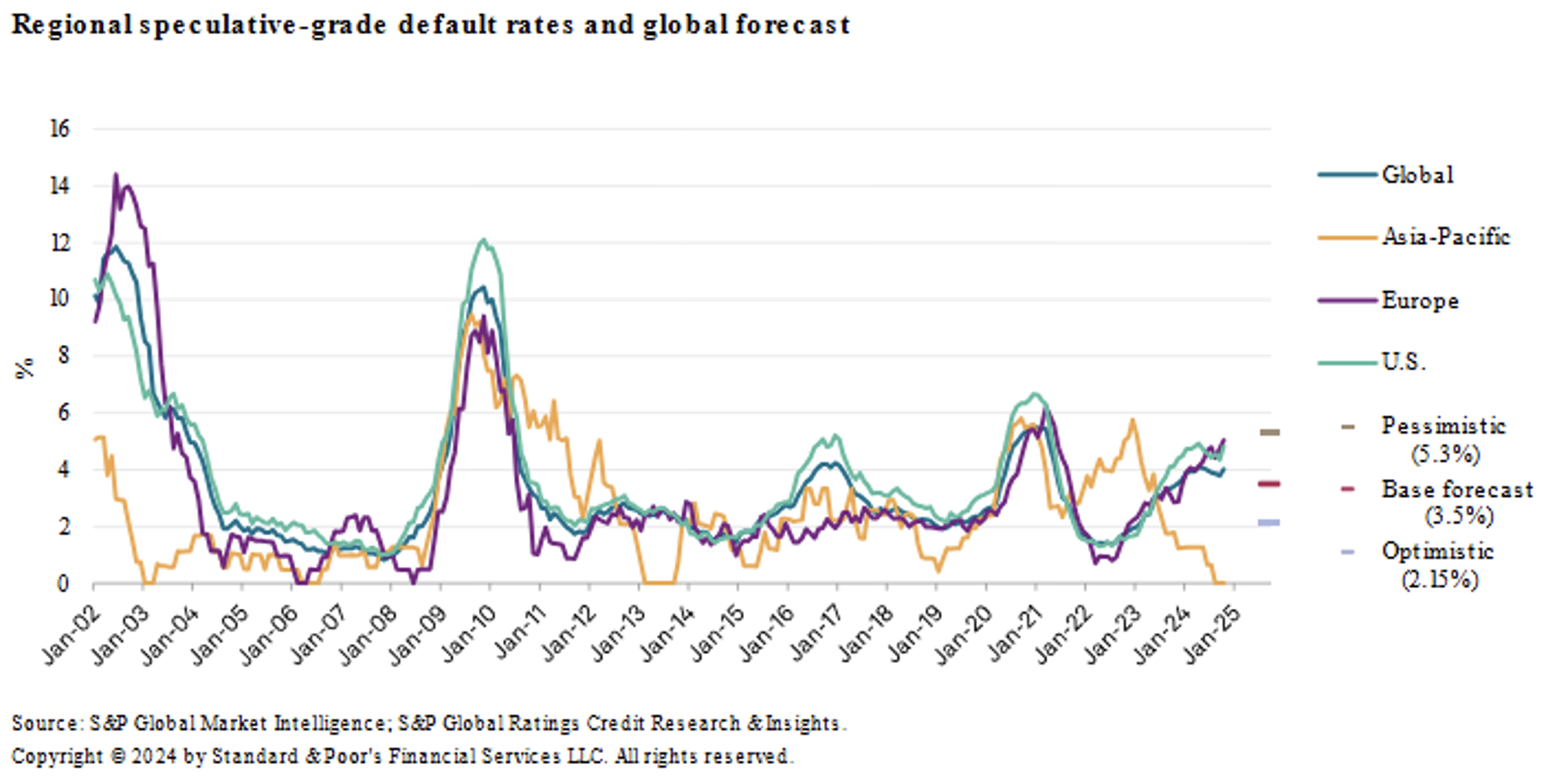

According to S&P Global (one of the primary credit ratings agencies), high yield default rates are increasing, ex-Asia-Pacific, and are higher than historical levels.

Source: S&P Global Ratings, through Q4 2024.

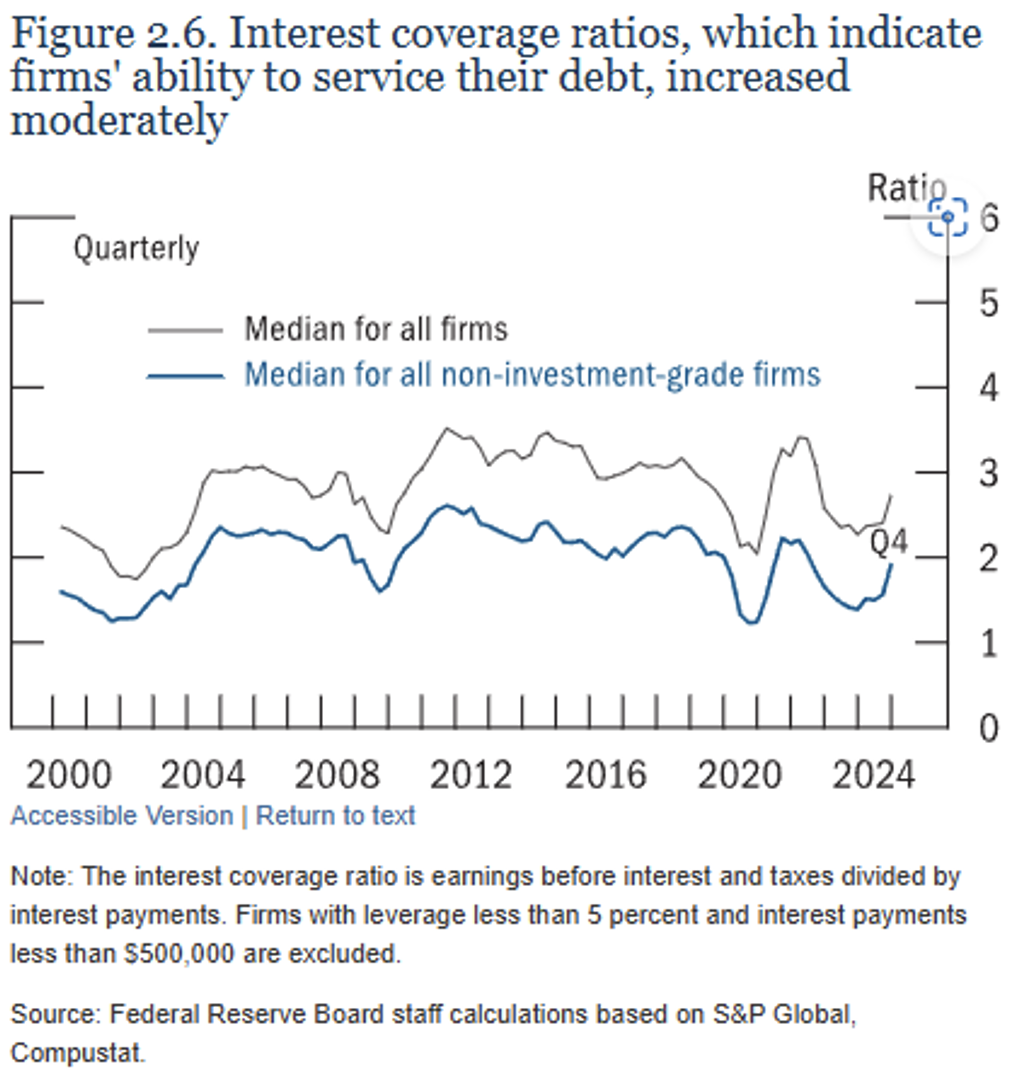

Interest Coverage Ratios

Hand in hand with default rates are interest coverage ratios. The more of a buffer a company has to cover its interest expenses, the less likely that company is to default.

We see an improvement in coverage ratios as we ended 2024 and so far in 2025.

Source: The Federal Reserve “Financial Stability Report.” April 2025.

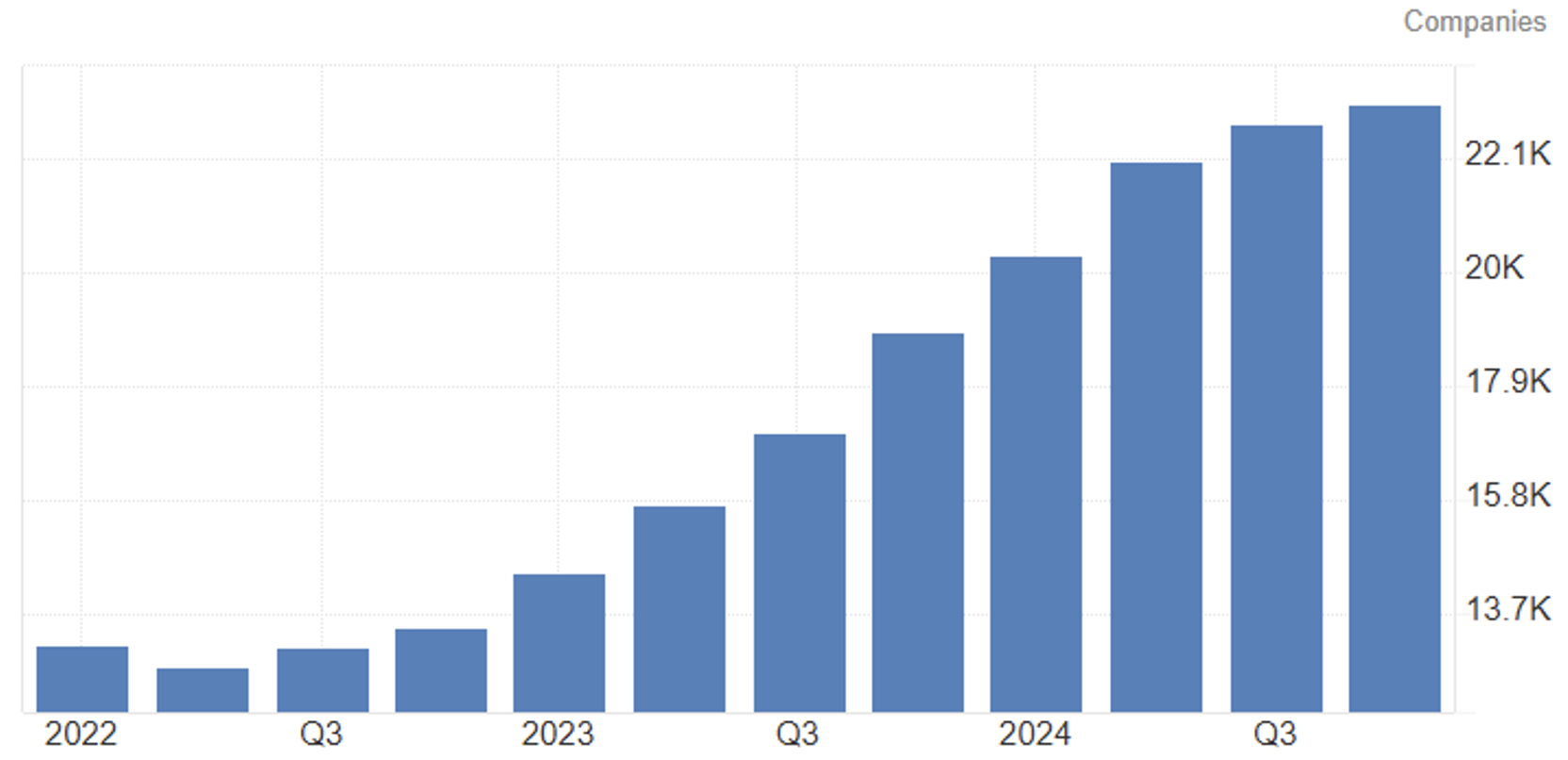

Bankruptcies

Here we see perhaps a first crack in the credit picture. Bankruptcies increased significantly in 2024, and a generally higher rate environment may lead to a continuation of this trend.

Source: TradingEconomics, US Bankruptcies, data through Q4 2024.

Bank Lending

An important part of the US corporate debt market is bank lending (often referred to as “leveraged loans”), which is dominated by smaller, unrated, or non-investment grade companies, most frequently on a floating rate basis.

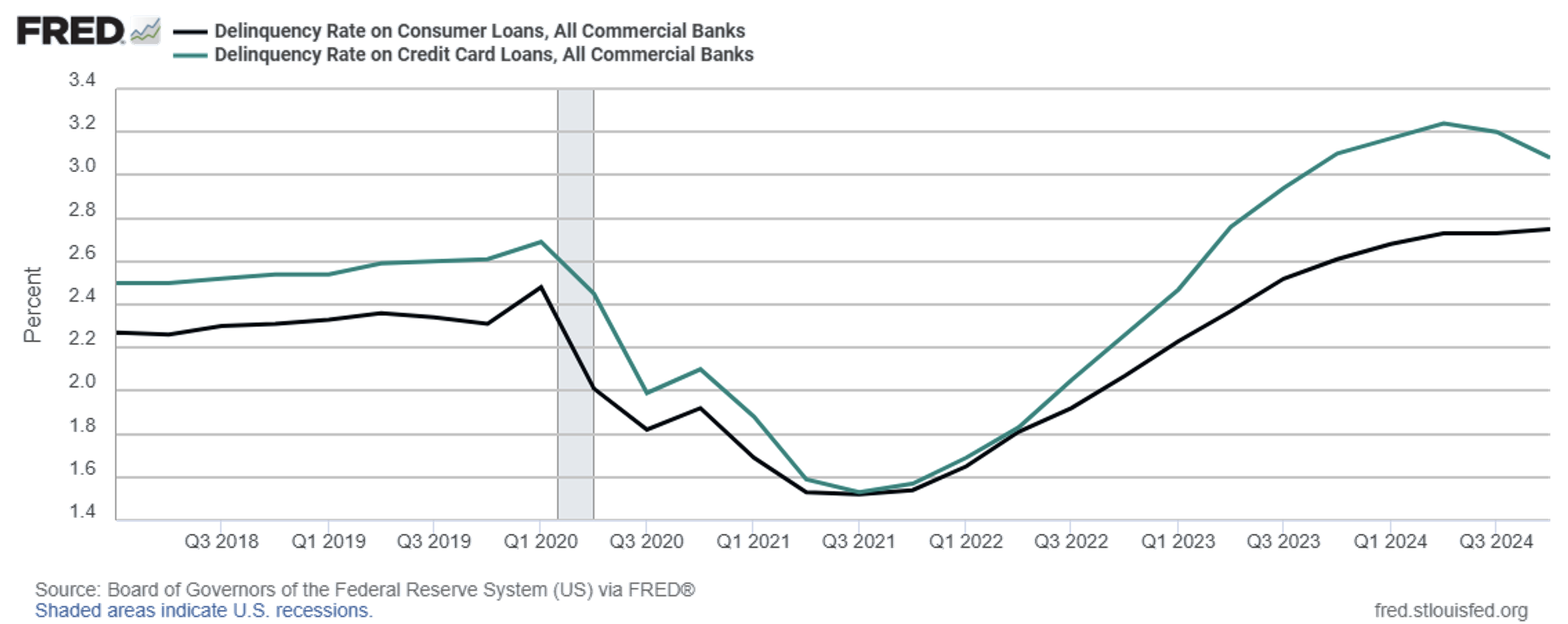

The first thing to notice is the steady rise since 2021 in delinquency rates on consumer loans from banks, especially credit card loans. This follows the dramatic downturn driven by the Covid-era debt forbearance and relief packages passed by Congress.

Consumers spent down their Covid stimulus money but did not stop their consumption and so began to finance themselves via credit. As rates have risen, so have delinquency rates.

The scaling on the y-axis of this chart perhaps over-amplifies the issue. Delinquency rates have risen but do not appear problematic just yet. As a point of comparison, following the Great Financial Crisis of 2008, delinquency rates on credit card loans rose to almost 7%. That said, the current delinquency rates are higher than the 10-year historical average.

Source: The St. Louis Fed (FRED), data through Q4 2024.

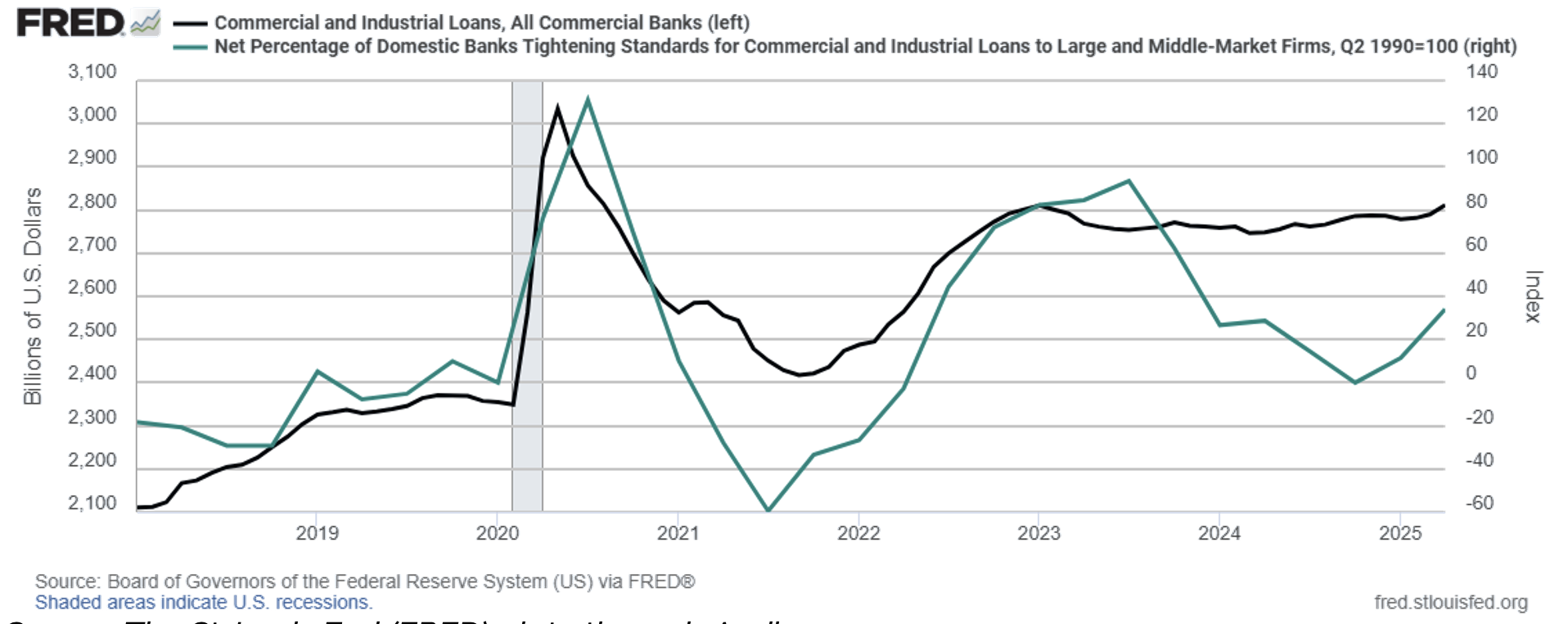

Following the market scare in 2023 caused by the collapse of Silicon Valley Bank, Signature Bank of New York, and First Republic Bank, banks in general tightened up on lending standards. That regime appears to have “normalized” somewhat.

Overall bank lending has been somewhat stable for most of the past two years. Following a loosening in lending standards through much of 2024, banks have tightened up again in 2025 as they grow concerned over the current economic and interest rates environments.

The volatility in the bank lending environment has been a primary driver of growth in private credit over the past several years.

Source: The St. Louis Fed (FRED), data through April 2025.

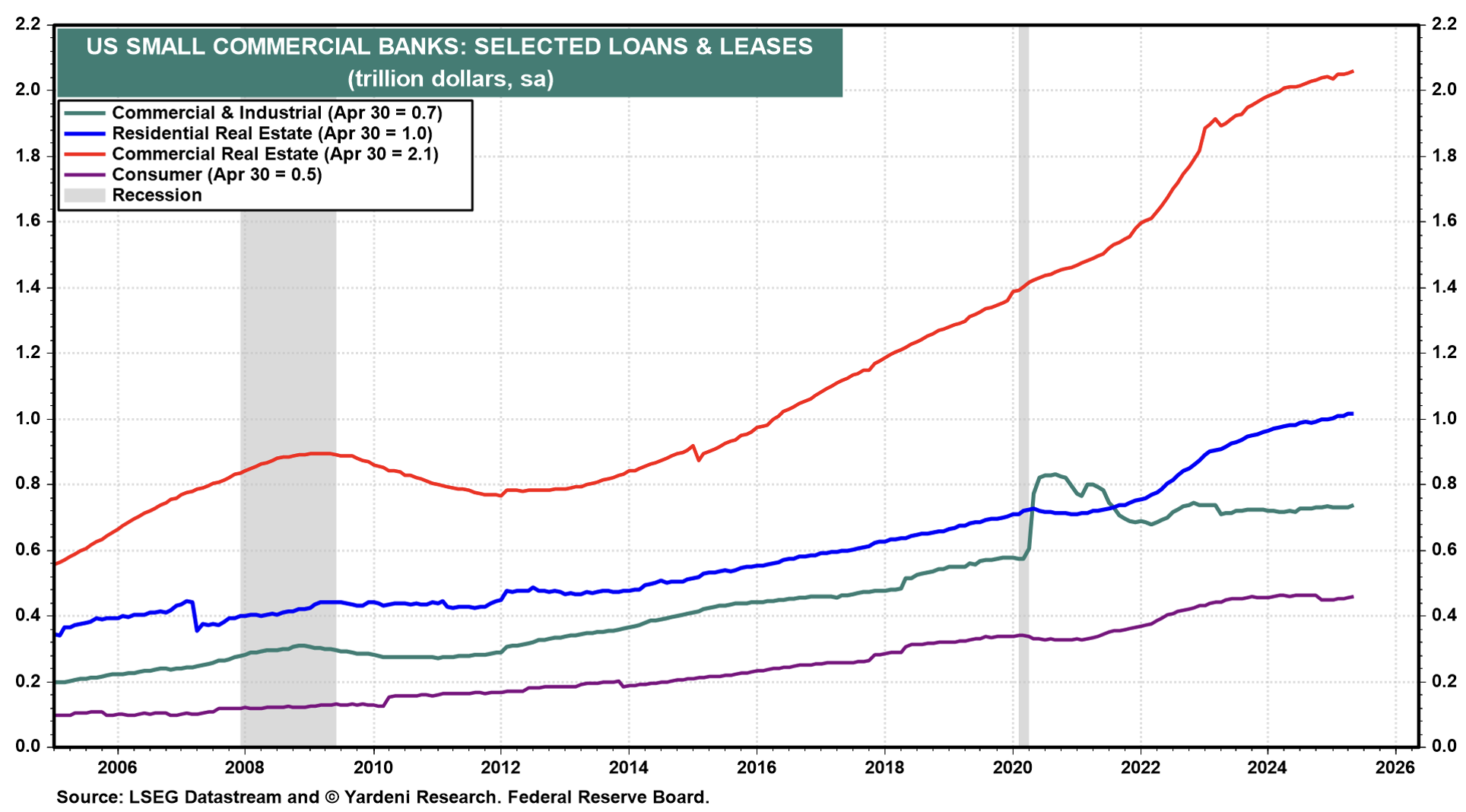

Commercial Real Estate

One last aspect on the bank lending front: commercial real estate. As a result of Covid, commercial real estate as a sector went into a tailspin due to the rise in “remote work” and correspondingly high vacancy rates.

We are recovering from that, and more firms are requiring workers to return to their offices at least several days a week. But the hangover remains for commercial real estate.

Unfortunately, this is the sector where small and medium-sized banks are most exposed, meaning we may see more delinquencies and defaults going forward, especially if rates rise over time. This may continue to put pressure on banks as well as borrowers.

Source: Yardeni Research, as of April 30, 2025.

Summary and Interpretation

We remain generally comfortable with the current rate and credit environment. Balance sheets overall remain in decent shape, rates and spreads (we believe) will remain range-bound (barring an unforeseen event), and there is, to quote an old colleague, “Income back in fixed income.” So, we are not negative on rates and credit.

That said, we believe the pressure on both rates and spreads is upward, not downward, and so we continue to believe there is muted potential total return in the public fixed income market.

We prefer private credit for those clients who can access it and are seeking higher yield.

As always, we welcome your questions and feedback.